The Clash Between Data Privacy and Government Control: The PayPal-Turkey Dispute

Introduction

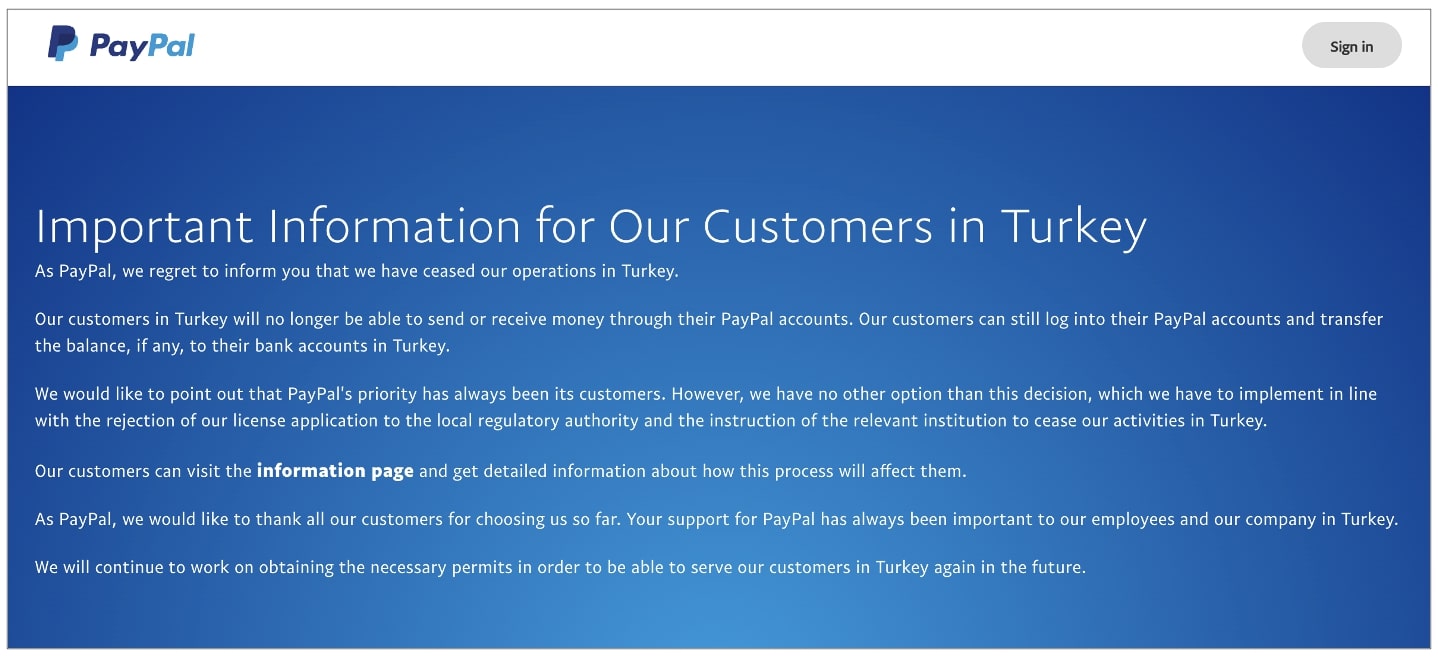

PayPal, the online payments giant, withdrew its services from Turkey in mid-2016 due to a long-running dispute over sharing users’ private payment data with the Turkish government. This move cut off an important channel for online cross-border commerce and sparked a debate over digital privacy versus national regulatory interests.

A Decade-Long Presence in Turkey

PayPal had operated in Turkey for over 10 years, serving millions of consumers and businesses by facilitating domestic and international digital payments. However, diverging views on how to balance privacy protections and lawful regulatory requests led to a standoff and PayPal’s ultimate exit from the key Turkish market.

Background of PayPal’s Turkish Operations

For over a decade, PayPal had built a sizable Turkish user base by enabling Turks to securely and conveniently send and receive payments online both domestically and cross-border. By 2016, millions in Turkey relied on PayPal for various online financial transactions.

Rapid Growth of E-Commerce and Digital Payments

Turkey experienced explosive growth in Internet usage and e-commerce during this period. PayPal positioned itself as a trusted partner supporting this transformation by offering Turks a seamless way to pay and get paid online through bank accounts, credit cards or digital wallets.

Turkey’s Demand for Full User Payment Data

In 2015, Turkish authorities requested that PayPal provide them with complete transaction records covering all payments to and from Turkey going back several years. They argued this data was necessary to enforce tax and anti-money laundering regulations.

Claims of Tax Collection and Security Needs

Specifically, Turkish officials wanted details on senders, receivers, amounts and other metadata for every PayPal transaction touching Turkey. PayPal was already sharing some data as required by law, but the government now sought full disclosure without limitation.

PayPal’s Refusal and Privacy Concerns

PayPal declined to open its systems and hand over users’ entire payment histories without consent. It argued this would breach its privacy policies andusers’ reasonable expectations regarding how their data is collected and used.

Commitment to Data Minimization Principles

The company noted it only collects the minimum user data necessary to operate its secure payments platform. Broad disclosure demands risked violating these principles of data protection while also undermining user trust.

Escalation of the Standoff

With negotiations stalemated, both sides dug in over mid-2016. Turkey did not retract its demand, while PayPal held firm that it could not share private financial records without explicit consent.

A Difficult Ultimatum

Having tried but failed to find a compromise respecting both regulatory needs and privacy, PayPal informed Turkish authorities in June 2016 that it would be withdrawing entirely from the Turkish market by year’s end unless the data request was narrowed.

Impact on Turkish Businesses and Consumers

The exit of PayPal from Turkey dealt a blow to the country’s significant digital economy, which had come to rely on the payments provider’s services.

Loss of a Vital Online Payments Gateway

For Turkish exporters and importers engaged in cross-border e-commerce, losing PayPal’s platform deprived them of a trusted way to receive international online payments for goods and services. This undermined their ability to transact business globally.

Reduced Financial Inclusion and Opportunity

Domestically, PayPal’s absence restricted opportunities for digital entrepreneurship and financial inclusion in Turkey’s growing online services sector. Many small businesses who previously operated via PayPal faced more friction receiving and sending online payments.

Political Dimension of the Regulatory Clash

The dispute took on political overtones as privacy advocates accused Turkey of overstepping limits on access to digitally stored private citizen data.

Debate Over Sovereignty Versus Individual Rights Online

Critics argued Turkey was attempting to assert too much regulatory control and surveillance over digital platforms and commerce passing through its borders. In their view, requesting blanket user payment data trampled individual privacy rights.

Counterarguments Supporting Turkey’s Stance

Meanwhile, Turkish authorities defended their position as a sovereign right to obtain information necessary for important policy objectives like fiscal enforcement and protecting citizens from financial crimes.

Outlook for Potential Resolution

As of early 2022, PayPal remains withdrawn from Turkey despite attempts to find a middle ground. Any return would require reconciling opposing stances on data handling.

Need for Balance Between Privacy, Sovereignty and Innovation

Industry experts note future agreements will demand innovative solutions balancing privacy, appropriate oversight and the fluid nature of cross-border digital trade. All sides must show flexibility.

Prospect of Regulatory Compromise Remains Distant

However, the gulf between Turkey’s asserted regulatory authority and PayPal’s commitment to data protection principles remains wide. Substantial policy shifts on either end may be required to bridge this divide.

Implications for Global Digital Trade and Data Governance

The unresolved PayPal-Turkey spat highlights tensions at the intersection of privacy, national laws and new digital business models operating across borders.

Case Provides Lessons on Data Flows and Oversight Challenges

The dispute shows how governments and companies must thoughtfully cooperate on clarifying data rules forFinTech and cross-border digital commerce to thrive without compromising privacy or regulatory needs. Global governance standards could help.

Need for Proportional, Transparent Regulation of “Big Data”

Both overseers and oversees must find consensus around reasonable, even-handed data policies for large platforms. Excessively broad or opaque demands risk undermining confidence and innovation in the very digital economy all seek to enable. In conclusion, the PayPal withdrawal from Turkey spotlights difficult questions at the heart of balancing privacy protections, data sovereignty and cross-border digital advancement—issues certain to shape global commerce for years to come. Good faith on all sides will be needed to work through such clashes constructively.